Articles

What is Skills Development Levy - SDL

If you are an employer in South Africa, you may have to pay a skills development levy (SDL) to the government. This levy is designed to encourage learning and development in the country and to help improve the skills of your employees.

What is SDL and who must pay it?

SDL is a levy that is calculated as 1% of the total amount that you pay in salaries to your employees every month. This includes wages, overtime payments, leave pay, bonuses, fees, commissions and lump sum payments.

You must pay SDL if you are registered with the South African Revenue Services (SARS) and if your total remuneration subject to SDL (leviable amount) paid or due to all your employees over the next 12 month period exceeds R500 000.

Some employers are exempt from paying SDL, such as:

- The public service in the national or provincial sphere of government

- Religious or charity organisations

- Public entities that get more than 80% of their money from Parliament

- Public benefit organisations (PBOs) that are exempt from paying income tax and only carry on certain educational, welfare, humanitarian, health care, religion, belief or philosophy public benefit activities or only provide funds to these PBOs

- Municipalities that have a certificate of exemption from the Minister of Higher Education and Training

How do you pay SDL?

You must pay SDL within seven days after the end of the month during which you deducted the amount from your employees’ salaries. If the last day for payment falls on a public holiday or weekend, you must pay on the last business day before the public holiday or weekend.

You must pay SDL by completing the Monthly Employer Declaration (EMP201) and submitting it to SARS. You can do this online through eFiling or by electronic payments through the internet (EFT).

You must also indicate which Sector Education and Training Authority (SETA) you belong to when you register with SARS. SETAs are responsible for managing and administering the skills development funds in different sectors of the economy. They also provide training programmes and grants for employers and employees.

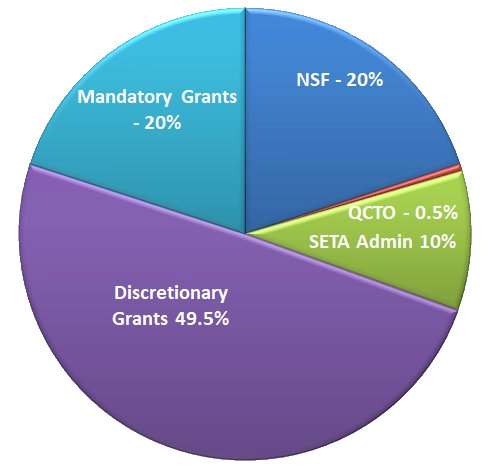

Skills Development Levy Breakdown

What if you fall under more than one SETA?

If your business falls under more than one SETA, you must choose one that is best for your workplace. You should consider the following factors when making your decision:

- The composition of your workforce

- The pay of the different workers

- The training needs of the different workers

Why should you pay SDL?

Paying SDL is not only a legal obligation, but also a benefit for your business. By paying SDL, you contribute to the National Skills Fund, which supports various skills development initiatives in the country. You also enable your employees to access training opportunities and grants from your SETA. This can help improve their productivity, performance and morale.

Paying SDL can also help you claim tax deductions for your training expenses. You can claim up to 20% of your leviable amount as a deduction from your income tax if you submit a workplace skills plan and an annual training report to your SETA.

Paying SDL is therefore a worthwhile investment for your business and your employees. It can help you develop a skilled and competent workforce that can meet the challenges and opportunities of the changing economy.